Published due to the large -volume holding report on the acquisition of a small investment port of Invesco Office JRIT investment corporation

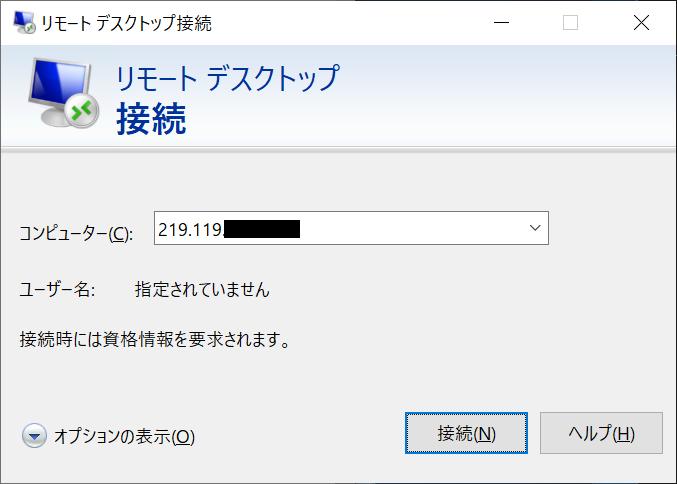

Starwood Capital Japan KK・提案予定の公開買付価格は2020年10月期決算で開示された1口当たり純資産額(NAV)17,684円を上回る水準・インベスコ・オフィス・ジェイリート投資法人の投資主は、過去1ヶ月の終値単純平均値及び3ヶ月の終値単純平均値に対して、それぞれ14.68%及び23.71%のプレミアムを取得する・非上場化により、長期的な資本投下による保有物件の改善が可能[April 2, 2021: Tokyo] The Starwood Capital Group (hereinafter referred to as "Starwood Capital"), a global investment management company specializing in real estate and energy infrastructure investment.Today, the 101 Investment Business Liability Association and 5 other investment vehicles (hereinafter referred to as "co -owners"), which are managed and operated by Starwood Capital, will be on March 26, 2021.・ Investment entrance of the office / JRET investment corporation (securities code: 3298) (hereinafter referred to as “target investment”).It was announced that it was disclosed in a large -volume holding report submitted to the Kanto Finance Bureau that it was acquired in collaboration with 07 %.In the large -scale holding report, the purpose of holding the target investment door by the co -owner has acquired the management right of the Invesco Office J -Le Lite Investment Corporation by purchasing the public purchase, and the invisco office JRET investment corporation is closed.He states that he is going to do.The co -owner intends to set the public purchase price at 20,000 yen per unit.The price to be presented in the public purchase is 13 for NAV17,684 yen per unit disclosed in the financial results for the fiscal year ending October 2020..It is a price with 10 % of the premium, 14 for the closing price of the investment in the Invesco Office Jay Let Investment Corporation on April 1, 2021..09 %, 14 for the end of the end of the past month per unit 14.68 %, 23 for the last three months per unit, 23 for the simple average..It is a price with 71 % premium. It is not listed with sufficient capitalization under the structural turmoil of demand trends in office properties that have been expanded by the new colon virus infection and the short -term price variable facing the global market. Starwood Capital recognizes that the investment corporation can actively work on issues such as revision and renewal of rental contracts, optimization of capital structures, and adopting capital management policies. Kevin Lee (in Japan's station resident), the manager of Starwood Capital and the head of the Asian real estate sector, said, "In the public purchase, the investors will get a premium that exceeds the current net assets. So, it is possible to immediately realize the attractive value of the investment exit. At the same time, by non -listing portfolios, it is not a listed REIT, but a long -term structure that can only be realized by a non -listed structure. You can implement capital -saving measures to improve the value. These improvements can benefit all stakeholders of Invesco Office J -Let Investment Corporation and have the Asian Pacific regional headquarters. We believe that we will show our long -term commitment to the market. We will work on constructive dialogue with asset management companies, including continuous roles, for this proposal. " For more information about the public purchase under the plan, please visit this website as soon as you can access it. https: // www.StarWoodJapantob.JP/ Starwood Capital entered the Japanese market in 2001, and then invested in hospital facilities, industrial facilities, apartments, offices, etc. through multiple Starwood Capital funds from 2001 to 2011. The cumulative transaction amount in Japan at that time was about 900 million dollars. In January 2020, Starwood Capital moved the regional control base in Asia from Hong Kong to Japan, and in January 2021, the regional control base was relocated to Japan, and the first transaction was announced. Starwood Capital is investing in more than 30 countries around the world. We build a wide range of assets by investing in private hotel platforms and residential real estate portfolios, which attract attention, and manages assets with our own real estate management companies. In addition, we have a wealth of achievements and experience in private transactions. Starwood Capital Groups are investment management companies that focus on real estate, energy infrastructure, oil and gas, mainly the Starwood Capital Group. Through the Company and related companies, 16 offices are developed in seven countries around the world, and about 4,000 employees are available. After its founding in 1991, the procured equity capital has reached about $ 55 billion, and its current assets have grown to more than $ 75 billion. Starwood Real Estate Income Trust, a variety of opotuninity funds, while flexibly shifting the asset classes, regions, and positions in the portfolio when the characteristics of risk and return are changed. We have invested in real estate in almost all fields around the world through private recruitment REIT. Starwood Capital also operates Starwood Properties Trust (NYSE: STWD), the largest commercial real estate investment trust securities in the United States, and has utilized more than 63 billion dollars since its establishment. It is operated for debt and stock investment of more than 100 dollars. For the past 29 years, the Starwood Capital Group and its related companies have implemented investment strategies in private sector and public sector and have built one of the world's leading investment companies. Detailed information is www.StarWoodCapital.Please see COM. Disclaimer [Recruitment regulation] This press release is a reporter announcement for publicly disclosed the schedule of public purchases disclosed in the mass holding report, and applications for applications such as sales or purchases related to the public purchase or application. It is not created for the purpose. In the future, if the public purchase is implemented in the future, when applying for sale, etc., you will always be able to see the public purchase manual for the public purchase, which will include important information, and then the investors. Please make it at your own discretion. This press release does not fall under the recruitment of applications for sale or the solicitation of the purchase application, or the facts of this press release (or part of it) or its distribution in the future. There is no basis for any contract pertaining to the public purchase scheduled for implementation, and it is not possible to rely on these at the time of conclusion. [US regulations] If public purchases are implemented in the future, the public purchase is specified in the Financial Instruments and Exchange Law (Act No. 25 of 1946 (including subsequent amendments), "law"). The procedures and information disclosure criteria are implemented, but these procedures and criteria are not always the same as the procedures and information disclosure criteria in the United States. In particular, the Securities Exchange Act (SECURITIES EXCHANGE ACT OF 1934) (including subsequent amendments) (hereinafter referred to as the "US 1934 Stock Exchange Law") Article 13 (E) or 14 (Article 14) (Article 14). D) The rules specified under the section and the same law will not be applied to the public purchases implemented in the future, and it is assumed that the public purchases will be implemented in the future in accordance with these procedures and standards. Hmm. The financial information included in this press release is from the financial statements created based on the Japanese accounting standards, and the financial statements are in compliance with the common accounting standards in the United States. It is not necessarily the same as the financial statements of the company that requires creating various statements. In addition, the co -owners (excluding the Limited Partnership established in Delaware State in the United States) and the subjects are mainly established outside the United States, and their officers are residents outside the United States. Due to the fact, it may be difficult to exercise the rights or claims that can be asserted based on violations of US securities -related laws. Furthermore, based on the violation of US securities -related laws, it may not be possible to file a lawsuit or executive in the United States in a foreign court. In addition, there is no guarantee that you will be able to take the jurisdiction of US courts and related people outside the United States. The co-owners and the "Covered Person" defined in Article 14-5 (C) (3) of the Stock Exchange and Law in 1934, the Law of the Stock Exchange in 1934, within those normal operations. Unless it is carried out in accordance with the requirements of the Japan Financial Instruments Trading Related Law and other applicable laws and regulations, in accordance with the requirements of the Stock Exchange Law Regulations 14E -5 (B) Alternatively, in the customer's account, the purchase period such as the purchase period before the start of the public purchase to be implemented or in the public purchase (hereinafter referred to as the "public purchase period") regardless of the purchase. Or, it is prohibited to perform acts toward it. Such purchases may be made at market prices through market transactions or at prices determined by negotiations outside the market. If information about such purchases is disclosed in Japan, the information will be disclosed in English on the website (or other disclosure method) of the person who purchased the purchase. [Language] All procedures related to the scheduled public purchase will be performed in Japanese unless there is a special description. All or part of the documents related to the public purchase will be created in English, but if there is a discrepancy between the English and Japanese documents, Japanese documents will be prioritized. [Future prediction] This press release includes descriptions about the future. The actual results may vary greatly from the descriptions of these future, depending on the known or unknown risk, uncertainty, or other factors. The co -owners or their affiliates cannot guarantee that the descriptions of such future will be correct. The description of the future in this press release is based on the information that the co -owners and others have at the time of this press release, and are required by laws and regulations. Alternatively, the affiliates do not have to update or modify the description to reflect the future events and situations. [Other countries] Depending on the country or area, legal restrictions may be imposed on the announcement, issuance, or distribution of this press release. If so, pay attention to those restrictions and comply. The announcement of this press release, etc., shall not be the invitation of an application for purchases of securities or sales for the public purchase in the future.

※以下、メディア関係者限定の特記情報です。個人のSNS等での情報公開はご遠慮ください。このプレスリリースには、メディア関係者向けの情報があります。

If you register as a media user, you can browse various special information such as contact information of corporate staff and information on events and press conferences.* The contents vary depending on the press release.

- プレスリリース >

- Starwood Capital Japan KK >

- スターウッド・キャピタル、インベスコ・オフィス・ジェイリート投資法人の全発行済投資口を1口あたり20,000円で取得する計画を公表

![Lenovo's 8.8 inch one-handed tab "Legion Y700" full specs released! [Is the price in the 40,000 yen range?]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/207e1be231154e91f34c85b4b1d2126c_0.jpeg)

![EVsmart blog Toyota's electric car "bZ4X" that makes you feel comfortable with electric cars and quick chargers / No% display of battery level [Editorial department] Popular articles Recent posts Category](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/752542064665dc2bd7addbc87a655694_0.jpeg)