Next year, high school curriculum guidelines will be revised, and "investment education" will be added to home economics classes. It is said to be "not just investment and financial education, but an interest in economic management, planning and lifelong investment in life with a view to life", but many teachers have no investment experience, It is said that voices of anxiety are rising. Therefore, the other day, we gathered faculty members and gave a lecture on "How to think about investment" by a professional investor. The lecturer is Kazunari Okuno, CIO (Chief Investment Officer) of Norinchukin Value Investments, which manages a 400 billion yen fund for institutional investors. Mr. Okuno said, ``Teacher, what should I do to become rich? (Diamond Publishing). Let me introduce the essence of the lecture.

Money is the reward for saying "thank you"

I think there are quite a few Japanese people who are allergic to investments and money. But I said, 'Teacher, what should I do to become rich? ], but money is a sign of "thank you" and a price for "thank you".

Investment is the word "invest" in English. It means "to dress". That's why we dress and decorate money, and have money redecorated. For example, it's a relatively positive word that turns money into stocks, bonds, real estate, and so on.

Assuming you have a 50 million yen farmland, what is in your head? Most of the people planted seeds in the farmland, watered and fertilized it rain or wind, and harvested crops from there. When I put it up for sale, it was 5 million yen. That's an investment of 5 million yen profit for 50 million investment, 10% profit. What would you do if you bought farmland for 50 million yen and it would be 75 million yen in half a year, or 25 million yen in a year? I don't think there is anyone who thinks like that.

Nevertheless, the moment money becomes a stock certificate, I wonder what it would be like if the stock I bought at 500 yen today became 750 yen in half a year, or what if it went down to 250 yen. More to the point, I think it would be nice if it was 503 yen in 3 seconds. It's funny to begin with.

In the first place, what is a stock, for example, a company called Toyota Motor Co., Ltd. struggles with automakers around the world to make cars that everyone says "thank you", and then for 1 year, 3 years, 5 years. , The concept of sharing the profits that have been raised for a long time.

Stocks are called "shares" in English. Shareholders are called “shareholders”. Owning shares in a company means that you own the company.

I'm sure you use Amazon at least three or four times a month, and what happens when you buy Amazon stock is that you become an Amazon owner. Get Jeff Bezos, who is probably more capable than you, to work hard. Being a shareholder means providing value to the world, collecting a lot of "thank you", earning money, and sharing it.

A company that can collect a lot of "thank you" is a company that has solved many customers' problems. A company that can collect a lot of "thank you" can make a lot of money, and a company that can keep receiving "thank you" can make a sustainable profit. This is the principle of capitalism.

I think there is a story like this as a misunderstanding about investment. You can easily make money by looking at the monitor and selling or buying it. It seems that if you lose it, you will have nothing left. When I go to a bookstore, I hear that there are a lot of books by millionaires like "Make 000 million yen with virtual currency!" When I see such things, I think it's normal to think, ah, this is something that children can't teach. But this kind of talk is "speculation". It's almost like gambling. Gambling is fun, but when it comes to whether you can get money from it, there is no such thing. Because it doesn't produce "thank you".

There is one thing that high school students should definitely know, and that they should never remove.

There is no 100% story that it will be easy and profitable in a short time.

Teachers and parents of high school students should know how hard it is to get money. In spite of this, it is strange to think that once you become an investment, you can easily make money right away.

But it is said that living expenses will not be enough in the future. A little while ago, there was a lot of noise about the "20 million yen problem." This is because the elderly today receive an average pension of about 200,000 yen a month, and spend an average of about 250,000 yen a month for living expenses. The monthly income and expenditure will be a deficit of about 50,000 yen, so if it continues until the average life expectancy of about 90 years old, it will be about 20 million yen. But I think this is true. The reason for this is that the elderly today have an average of 20 million yen in savings, so they are simply living a life that fits their stature while using that savings. People who don't have any savings are supposed to be living on a 200,000-yen pension that cuts back on their living expenses, so I don't think it's right to generalize and threaten everyone. That's what I think.

However, there is no doubt that it is better to have a certain amount of savings as a preparation for when you want to live a somewhat rich old age or when something happens. As life expectancy increases, the amount of savings required increases.

And one more thing, you can't make more money by depositing it in the bank. This is true. Thirty years ago, the yield was 7%. If you deposit 1 million yen in 1990, you will get 2 million yen in 2000. It's doubled in 10 years. But if you deposit 1 million yen now, it is 0.002%, so you will be surprised that even after 10 years you will still have 1,000,200 yen.

I think this is the background of teaching investment in high school because you don't have enough money and you can't earn interest at all, so let's invest. However, I think that the idea that it's okay to just teach them how to invest in stocks and investment trusts is a bit wrong in the first place.

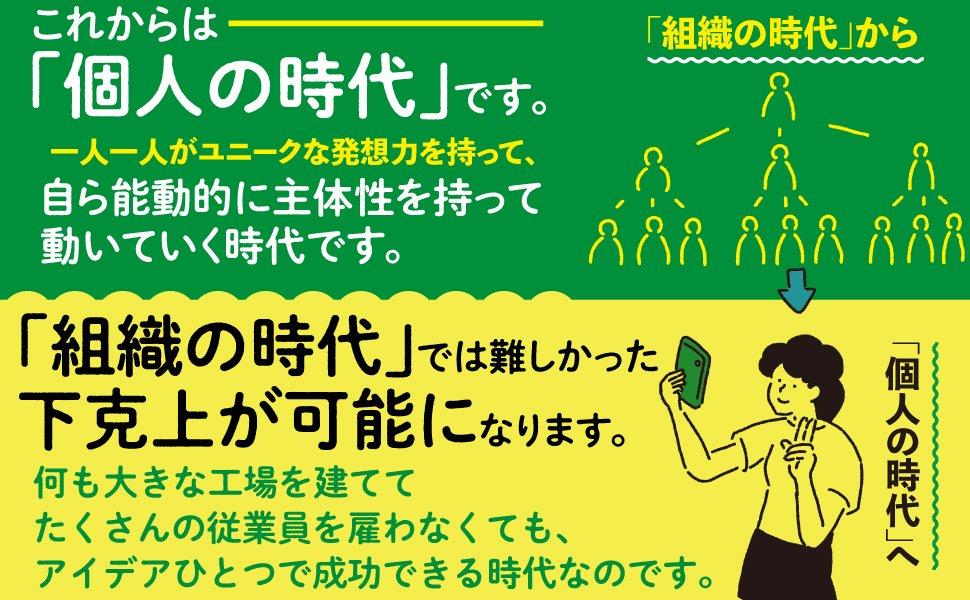

It's a fact that we don't have enough money. However, young people, such as high school students and university students, have time. What should I do at that time?

Money has an interesting property, and if you say you want to be rich and chase money, it will run away. If you chase money, it will run away.

But money is something you like. Thank you. If you take advantage of the habit of collecting money where there is "thank you", you can actually increase your income in the long term.

So the most important thing when you're young is to invest in yourself. Study English, study programming, delve deeper and deeper into what you like, invest in yourself, and eventually become a person who will be thanked by everyone. That is self-investment. It never hurts to train your abilities. This is a safe, secure and high-yield investment that will generate future income.

That being said, I think many high school students say they don't know what to invest in. In that case, check three criteria. ①What do you want to do to be the kind of person who says “thank you”? ②What is your favorite thing? ③ What will your favorite thing be in the future? There are three. You can do whatever you like. Maybe it's because I can only continue to do what I like.

First of all, what do you want to do to be appreciated? That's what's important. For example, a foreigner is having trouble finding a way, and is wandering around wondering where he wants to go. I want to be the kind of person who says "thank you" to people like that. I think this is a very admirable thing. Let's study English then. If you study English thoroughly and become an interpreter, you will receive a completely different salary than working part-time. This is how you can use "time" to improve "ability" and eventually "money" comes in.

People who say that I really like games should study programming as much as possible and then work on the West Coast of the United States. When you enter such a world, you see something completely different. It's no good if you're just playing games.

Three Criteria for Choosing a Company to Invest

On the other hand, there is another way to invest. This is what it means to invest in others. The idea is to let Jeff Bezos do the work, let Amazon do the work. It's the same when you want someone else to work for you. Even when investing in others, you should invest in companies that people say "thank you" and companies that solve social problems. Then the company will make money.

Getting that share is stock investment. To put it bluntly, selling and buying in front of a monitor is gambling. In the sense of increasing income in the long term, I think it's okay to assert that it means increasing the risk.

So it's a mistake to go ask someone at a securities company just because you don't understand the story of investment. A securities company is a professional who sells and sells stocks, so if you go to them and ask them about investment, you might learn something a little different.

I don't think there is a single person who doesn't know about the company Nike. I am a shoe manufacturer. If you look at Nike's stock price over the past two years, it fell sharply in March 2020. It has fallen about 30% from about $100 to about $70, but this is the corona shock. But no matter what, people never stop running. There is no such thing as Nike going bankrupt. Everyone noticed it, and the stock price returned to normal soon. I'll be back soon and I'm doubling down now.

If you look at these price movements and think, ah, well, if you bought it when it was $70 in this corona and sold it now, it would double, it's a gambling brain. In the first place, I think that the theory is that stock investment is misunderstood. Would you really have been able to sit in front of the screen and buy Nike stock when you couldn't even buy a mask because of the coronavirus? It's an afterthought to buy a crashing Nike stock when you don't know what the world will be like in the future.

The investment I'm talking about is the story on the right. Since 1992, this blue has been getting more and more. This is Nike's profit. The red line is the stock price.

When you look at this, some of you may say that from 2015 to 2016, Nike's profits have increased dramatically, but the stock price has fallen. Is not.

Because this red line shows a whopping 77 times increase from 1992 to 2021. 77 times. That's why I'm the owner of a company that makes a profit. If you have Nike work for you, Nike will collect "thank you" from many people, so you will naturally make money.

There are three criteria for determining which companies to invest in, the same as the criteria for self-investment.

(1) What is the company doing, (2) What are its characteristics and strengths, and (3) What is the future of the company?

You can understand how Nike can collect so many "thank yous" from about three years ago. If you look at Ekiden, everyone wears thick-soled boots, pink shoes. That's a product called Vaporfly, but that's the source of "thank you". Just by putting a little carbon plate in the soul of thick-soled boots, you can increase the repulsive force. It's just a few percent of the runner's physical strength, but it can be preserved. This is a big problem for long distance runners.

If you watch the Olympics, they're all wearing those pink shoes. (1) Since its founding, Nike has collected more and more "thanks" in this way, and as a result, the stock price has risen. That's why I'm talking about becoming the owner of such a company.

And, of course, ② the advertisement by the top athlete. In today's terms, Nike developed Naomi Osaka's shoes, signed a contract to wear them and entered the U.S. Open, and actually won the championship. That's amazing. There are only companies like Nike or Adidas that can do such a huge amount of advertising on a global scale. That's how strong I am.

And ③ everyone wants to live long is a long trend that has been going on ever since Homo sapiens landed on this earth 60,000 years ago. And I don't want to live a long life with an illness. I want to live a long and healthy life. That's why people in developed countries start running. Statistically speaking, 1/10, if there are 130 million people in Japan, 13 million people are running. If this situation continues, Nike will naturally become profitable.

For example, in the case of Disney, ① Mickey Mouse, a character who has lived for nearly 100 years and is loved all over the world, can heal everyone.

And ② it's practically impossible to go beyond Mickey Mouse and create a dog character and distribute it all over the world. The second criterion is to be as strong as that.

And 3), Disney fans are not only growing in America and Japan, but also in emerging countries. Disneyland has opened in Shanghai, and the distribution service "Disney+" is attracting a tremendous number of subscribers in India and other countries. In emerging countries that are developing more and more, I think that Disney will be more and more entertaining and people will say "thank you" more and more.

If it is Coca-Cola, it is a company that can provide beverages that give you a refreshing refreshing feeling.

② We are doing business in an overwhelming competitive advantage. There are only Coca-Cola, Pepsi and Dr Pepper in the world. In Japan, it seems that there are various beverage companies, but if you go to America, you can say that there are basically only two companies. That's how strong it is.

And ③ the world's population is increasing tremendously. There are 7.8 billion people now. This 7.8 billion people will not decrease like corona. It will definitely become 9 billion people. At that time, the middle class that can drink carbonated drinks will grow even more. If there were only Coca-Cola or Pepsi at that time, Coca-Cola would still be profitable. Our investment is to think that it would be nice to own Coca-Cola stock.

In other words, you should become the owner of the company where ①, ②, and ③ overlap.

You choose a company by yourself, deposit money, and actually become the owner of the company. It's not about making money or something like that.

If you don't have business sense, whether you're a lawyer or a doctor, it's going to be tough from now on. Investing in stocks, buying and selling, is almost meaningless and futile, but investing in thinking about which company you should be the owner of is extremely important.

Get other companies to work with your own money, companies receive a lot of "thank you" and make the world better. Investing can actually make the world a better place. I want to convey that to high school students.

Kazushige Okuno Managing Director and Chief Investment Officer (CIO) of Norinchukin Value Investments Co., Ltd. He holds a BA in Law from Kyoto University and a Master in Finance from London Business School. Joined the Long-Term Credit Bank of Japan in 1992. After working for LTCB Securities and UBS Securities, entered the Norinchukin Bank in 2003. In 2007, he began managing a “long-term carefully selected investment fund”. Incumbent since 2014. A pioneer of long-term selective investment in Japan, he is one of the few fund managers who invest in Buffett style. Based on its management philosophy and methods that have accumulated a track record in investing for institutional investors, it has also developed the "Obune" fund series for individuals. His books include Investment as Education and Teacher, What Should I Do to Become Rich? (Diamond), etc.[Message from the author]

Doctor, what should I do to get rich?

Okuno Kazunari: Author Price: 1650 yen (tax included) Date of issue: March 2021 Format/bookbinding: 46 average, 224 pages ISBN: 978-4-478-11253-3Just like everyone else Gone are the days when you could just go to school, get a job like everyone else, and do what everyone else did, and you'd be "middle class". How should we live in a changing world? What should I do to become rich? Beginning with the frank question of a high school student, "What should I do to become rich?", you can enjoy learning about investment through dialogue between students and teachers. Learning "money education" is the first step to get closer to "rich" that everyone longs for. In this book, "money professionals" explain "money mechanisms" such as the mechanism of the world that anyone with money knows, facts about money that you should know, investment and compound interest, changes in the times, the mechanism of the economy, etc. I will explain in an easy-to-understand manner with illustrations. The author, Kazunari Okuno, is a popular author who has also written "Investment as Education to Become a Business Elite". He is a fund manager who has entrusted about 400 billion yen in assets from professional investors and continues to improve its investment performance. I took up the brush from the desire to spread "investment" to the world in order to enrich the Japanese people, such as giving classes on "investment" for high school students and acting as a lecturer in an investment practice program. From 2022, “investment” will be included in high school classes. This is a textbook-like book that is recommended not only for high school students, but also for those who want to learn again. Let's learn "money education" that you can't ignore if you didn't know it.

Click here to purchase! → [Amazon.co.jp] [Kinokuniya BookWeb] [Rakuten Books]

![EVsmart blog Toyota's electric car "bZ4X" that makes you feel comfortable with electric cars and quick chargers / No% display of battery level [Editorial department] Popular articles Recent posts Category](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/752542064665dc2bd7addbc87a655694_0.jpeg)

![Lenovo's 8.8 inch one-handed tab "Legion Y700" full specs released! [Is the price in the 40,000 yen range?]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/207e1be231154e91f34c85b4b1d2126c_0.jpeg)